News & Information

Take control of your small business taxes by gathering your information in advance. By being organized, you will help your accountant save you time and money when you file. Follow these points:

Cash is king is a common expression in business. Surprisingly though, few owners or managers take the steps needed to manage their cash flow. By ignoring it, they will sometimes find an empty bank account and nothing to pay their bills with.

Shareholder loans refer to loans made by shareholders of a corporation to the corporation. The tax implications of such loans will vary depending on the jurisdiction, but usually, they are not considered taxable income to the shareholder.

An RRSP is more than simply an account for retirement savings. Yes, it’s a must-have when saving for retirement, but the Registered Retirement Savings Plan (RRSP) is an effective tax-planning tool.

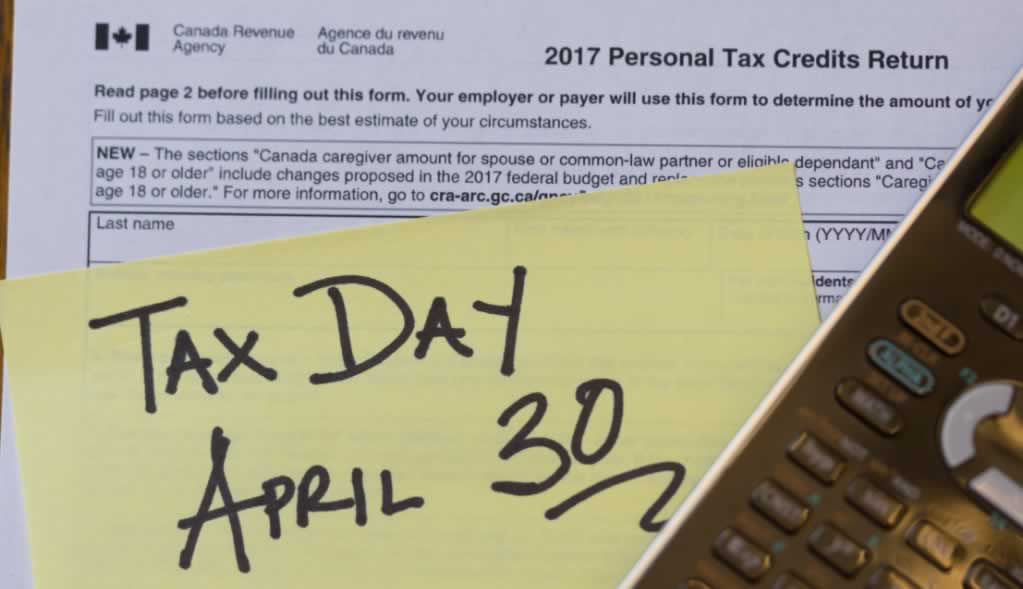

Through proper planning, simplifying the process of filing your tax returns for 2022 is easily done. By taking the time to prepare your records, you can speed up the process of receiving a refund and reduce the cost of services provided by your accountant or tax preparer to meet the tax filing deadline.

Small business owners and the self-employed start every year from groups like the semi-retired, up-and-coming entrepreneurs and those just wanting to follow their dreams. As you start down the road, don’t make the mistake of not staying in line with the Canada Revenue Agency (CRA).

Here are some important tips to follow:

The 2022 tax filing season starts in February. The filing deadline is May 2nd, as April 30th falls on a Saturday. The deadline is June 15th for self-employed individuals or anyone with a spouse/partner who is self-employed.

Keep more of your money by Income Splitting

Earning more than your spouse can create a situation where moving some of your income can reduce your combined taxes. Consider using these methods

If you would love to say goodbye to high accounting fees, the great news is that saving money in this area is often quite easy for many business owners. The number one rule is ensuring your records are complete and organized.

Paying yourself as a small business owner is an important decision. Determining how you do it will be very important concerning finances and taxes.

This season is one of the most important times of the year when thinking about finances. People are either out or shopping online, and businesses everywhere generally hire more people. Even in these COVID-aware times, parties can happen, and presents are usually given. In spite of all the hustle and bustle, smart people will consult their accountant so that they're prepared. Here are some tips for the holidays.

As the holiday season approaches, and with all of the news of late about the ongoing COVID-19 pandemic as well as the FLU season, we thought it would be good to pass along some ideas on how to stay safe while supporting small businesses.

3 Must Knows for any Small Business

Whether you're considering starting a business or are already in the game, there a few things you absolutely need to know to stay competitive in today's marketplace.

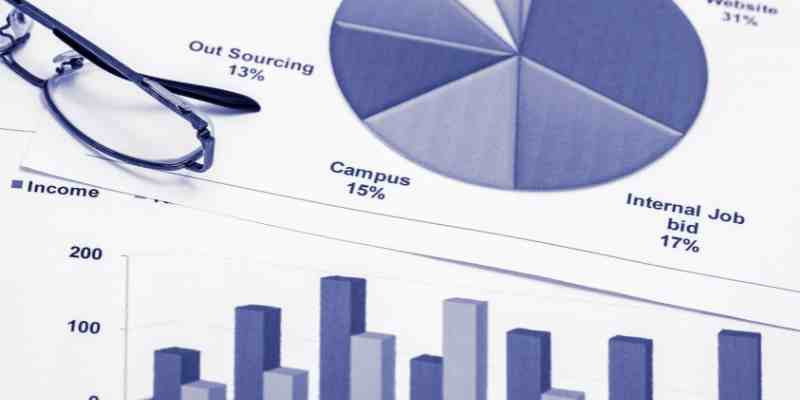

Maintaining good financial management is crucial to a firm’s survival. Timely and informed decisions are much easier when responding to changing conditions in today’s business world.

From time to time, the Canada Revenue Agency (CRA) audits tax returns and claims for rebates to ensure they comply with the country’s taxation laws. The objective is to ensure that taxpayers meet their obligations and receive amounts to which they are legally entitled.

Who are users, and what is the Basis of Accounting?

A “user” includes anyone who would receive the compiled financial statements. Users may be shareholders, investors, creditors and lenders, government, regulators, suppliers etc.

Not necessarily, but you might.

A Business Plan is a tool where management outlines what the company will do and how it plans to achieve its goals.

Having survived tax season, thousands of CPAs flock to beach resorts for 11 months of relaxation, cocktails and resting on their laurels. OK, not quite.

Continuing on with the discussion about TFSA's and RRSP's, we consider which one is best.

There is no single answer. It is not an either-or situation. Both plans have tax advantages, but some are greater than others, so it depends on your financial situation. You can use both plans if you have the capital to do so.

Plan for overall success - Not just for financing

Your business plan is as much of a road map of where you are going as it is to provide the information a lender will require before advancing funds to meet your needs. It serves both internal and external guidance. Internally, it will assist you in managing cash flow, capital expenditures and periodic issues. It is your crystal ball to guide your firm’s future. Externally it may include those who could be a part of your financial requirements, investors, a bank or your suppliers.

Chances are you’ve heard about the Tax-Free Savings Account (TFSA) and the Registered Retirement Savings Plan (RRSP). These accounts work harmoniously to enhance your finances through tax deductions, no tax, or other benefits. The sooner you open these accounts, the sooner they can help you towards your life’s goals.

It’s important to know the particular benefits of these accounts for various goals you may have.

As the new year starts, simplifying your tax filing process can be easily done by planning. When you take the time to prepare, it can speed up the process of receiving a refund, not to mention reducing the cost of services provided by your CPA as they get things done to meet the tax filing deadline.

That depends on whether your business is incorporated or not.

If you are incorporated, you will have to submit a T2 Corporate Tax Return for your company. That only covers your company; you will also have to file a T1 personal tax return.

Engaging in tax planning from the beginning of the year means that you can enjoy the benefits at tax time.

Tax planning is the broad concept of tax efficiency. Tax efficiency considers the larger financial picture incorporating individual age, goals, tolerance for risk and investment timeline. By incorporating tax planning, you uphold long-term wealth creation and protect your capital.

The beginning of the year is the best time to start to plan for tax savings. But, unfortunately, last-minute tax planning leads to lower returns and bad investments.

To understand the various tax-saving opportunities and ensure that you are headed in the most appropriate direction, consult with a professional and take suitable action to reap the benefits.