News & Information

Take control of your small business taxes by gathering your information in advance. By being organized, you will help your accountant save you time and money when you file. Follow these points:

When preparing your taxes, a deduction that is often overlooked is carrying charges and interest expenses. These charges are costs you incur to earn income from an investment, but only expenses for non-registered accounts will qualify.

Shareholder loans refer to loans made by shareholders of a corporation to the corporation. The tax implications of such loans will vary depending on the jurisdiction, but usually, they are not considered taxable income to the shareholder.

An RRSP is more than simply an account for retirement savings. Yes, it’s a must-have when saving for retirement, but the Registered Retirement Savings Plan (RRSP) is an effective tax-planning tool.

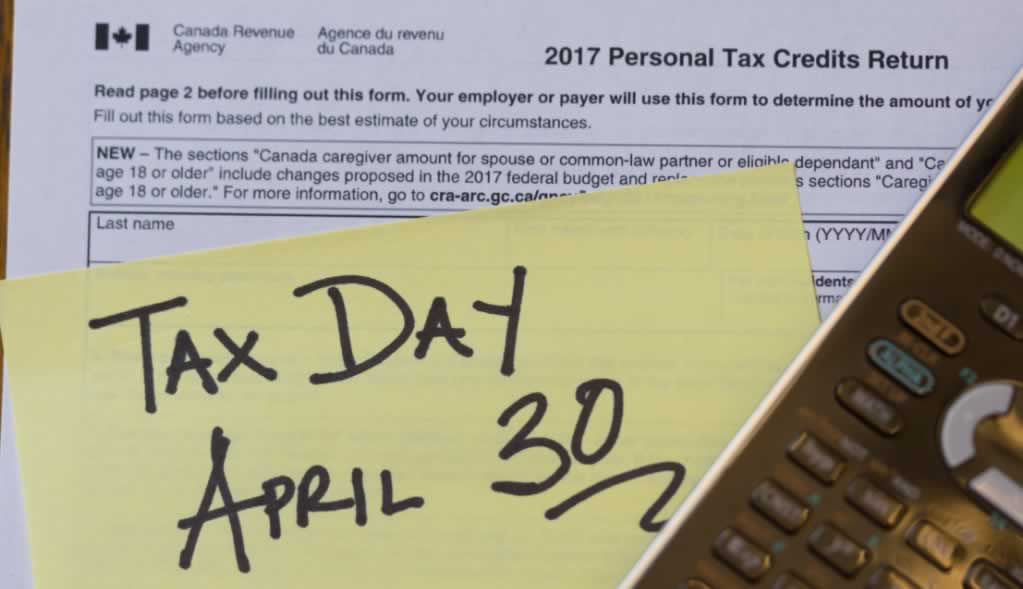

Through proper planning, simplifying the process of filing your tax returns for 2022 is easily done. By taking the time to prepare your records, you can speed up the process of receiving a refund and reduce the cost of services provided by your accountant or tax preparer to meet the tax filing deadline.

Small business owners and the self-employed start every year from groups like the semi-retired, up-and-coming entrepreneurs and those just wanting to follow their dreams. As you start down the road, don’t make the mistake of not staying in line with the Canada Revenue Agency (CRA).

Here are some important tips to follow:

The 2022 tax filing season starts in February. The filing deadline is May 2nd, as April 30th falls on a Saturday. The deadline is June 15th for self-employed individuals or anyone with a spouse/partner who is self-employed.

Keep more of your money by Income Splitting

Earning more than your spouse can create a situation where moving some of your income can reduce your combined taxes. Consider using these methods

Use our Tax Information Checklist

To start gathering your income tax details, click here to download our checklist. This will help you organize your information to bring into our office.

No doubt you have heard someone say, “I’m self-employed.” What do you think of when you do?

Paying yourself as a small business owner is an important decision. Determining how you do it will be very important concerning finances and taxes.

With the end of the year fast approaching, we thought it would be timely to discuss the medical expense deduction on your tax return.

Many people assume that if they fail to include an information slip with their income tax return, the Canada Revenue Agency ("CRA") will simply adjust the return to report the income and adjust the income tax accordingly. This is half correct! The other half of the equation is a little-known penalty the CRA imposes for repeated failure to report in...

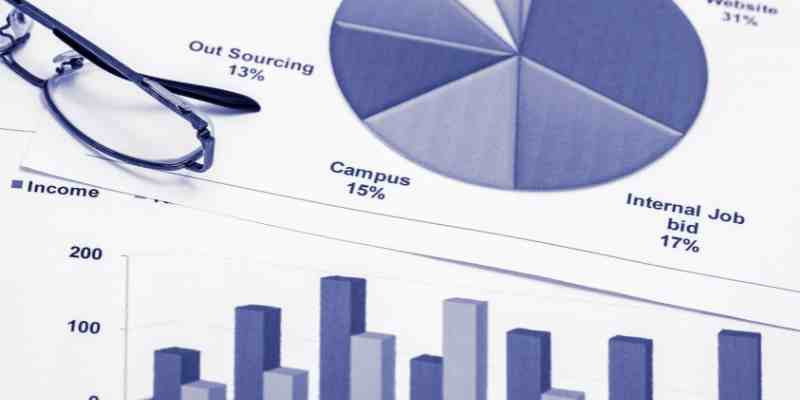

Maintaining good financial management is crucial to a firm’s survival. Timely and informed decisions are much easier when responding to changing conditions in today’s business world.

Our Canadian sales tax system has federal and provincial components. To simplify the differences, review each province’s tax system.

From time to time, the Canada Revenue Agency (CRA) audits tax returns and claims for rebates to ensure they comply with the country’s taxation laws. The objective is to ensure that taxpayers meet their obligations and receive amounts to which they are legally entitled.

Who are users, and what is the Basis of Accounting?

A “user” includes anyone who would receive the compiled financial statements. Users may be shareholders, investors, creditors and lenders, government, regulators, suppliers etc.

In Canada, accounting firms are letting their clients know about the new requirement for compilation engagements. This new standard is titled the ‘Compilation Engagement Report.’ This report will contain your company’s compiled financial details.

In Canada, accounting firms are letting their clients know about the new requirement for compilation engagements. This new standard is titled the ‘Compilation Engagement Report.’ This report will contain your company’s compiled financial details.

If you are self-employed, you may claim automotive expenses while conducting business.

If you use your car for personal and business travel, only expenses for business can be deducted. If you use it exclusively for business, you can expense all costs.

It is important to note that driving to and from the office is not deductible.

Business-related driving includes:

While in the past, small business owners mostly looked to print, television or radio, flyers or attending a trade conference to get their message out, today, advertising opportunities have become almost limitless.

The older types of advertising were, and still are, difficult to gauge the direct effect of their use, and they were costly. Except for time, today, many advertising methods don’t cost anything.

Not necessarily, but you might.

A Business Plan is a tool where management outlines what the company will do and how it plans to achieve its goals.

Giving gifts to clients can be a valuable method of building goodwill and loyalty. It’s one way to distinguish yourself from your competitors. Gifts are usually given during holiday seasons, for birthdays, significant transactions or simply as a thank you. When you buy a gift for use in business, you need to know if it qualifies as a tax deduction.

Having survived tax season, thousands of CPAs flock to beach resorts for 11 months of relaxation, cocktails and resting on their laurels. OK, not quite.

If you can't afford to pay the taxes owing, you should file your tax return by the deadline to avoid any late-filing penalty. Once you have submitted the return, call the Canada Revenue Agency (CRA) regarding the payment that is due. Under some circumstances, interest and penalties can be waived. More information can be found here.

Tax season scams involve fraudsters who try to dupe you into believing they represent the Canada Revenue Agency (CRA). These dishonest communications try to trick you into sending either payment for an outstanding amount or personal details about you they can use to commit fraud.

Here are a few examples of the scam messages you might receive by email, a phone call or by text:

The Government of Canada offers a variety of tax benefits to people with disabilities. These benefits are provided under the assumption that people with disabilities will have unavoidable, additional expenses that other taxpayers do not face. The Disability Tax Credit (DTC) is intended to act as a fairness measure for people with disabilities and their families.

Chances are you’ve heard about the Tax-Free Savings Account (TFSA) and the Registered Retirement Savings Plan (RRSP). These accounts work harmoniously to enhance your finances through tax deductions, no tax, or other benefits. The sooner you open these accounts, the sooner they can help you towards your life’s goals.

It’s important to know the particular benefits of these accounts for various goals you may have.

As the new year starts, simplifying your tax filing process can be easily done by planning. When you take the time to prepare, it can speed up the process of receiving a refund, not to mention reducing the cost of services provided by your CPA as they get things done to meet the tax filing deadline.

The Canada Revenue Agency (CRA) will use detailed guidelines to determine whether someone working for you is an independent contractor or an employee. It is important that you understand the difference and classify that person correctly, otherwise the difference could have a hugely negative impact on your taxes.

When trying to rectify the past, volunteering the details may help you avoid penalties, interest and the most important thing, criminal prosecution.

That depends on whether your business is incorporated or not.

If you are incorporated, you will have to submit a T2 Corporate Tax Return for your company. That only covers your company; you will also have to file a T1 personal tax return.

Do you consider yourself a DIY type of person?

How about the office worker who can help their neighbour with a computer problem or can cook a gourmet meal for a group of 10 at the drop of a hat? All this, in addition to being able to keep his workplace organized. You probably know people like that who display genius in many areas, on demand. Good for them; they can be treasures when you need a friend as they can sometimes save you money.

We don’t want to downplay the importance of such a helpful person, but some things in life require the skills of a trained professional. Does the phrase, “A Man Who Is His Own Lawyer Has a Fool for a Client” come to mind? Evaluating complex legal issues requires specific expertise.

Engaging in tax planning from the beginning of the year means that you can enjoy the benefits at tax time.

Tax planning is the broad concept of tax efficiency. Tax efficiency considers the larger financial picture incorporating individual age, goals, tolerance for risk and investment timeline. By incorporating tax planning, you uphold long-term wealth creation and protect your capital.

The beginning of the year is the best time to start to plan for tax savings. But, unfortunately, last-minute tax planning leads to lower returns and bad investments.

To understand the various tax-saving opportunities and ensure that you are headed in the most appropriate direction, consult with a professional and take suitable action to reap the benefits.